In this era of inflation, it is very difficult to save money from salary. You do not need any financial degree or any mastery in financial advice to save money from salary.

Just basic knowledge of money management is enough for you to save money every month. Many people are living a very stressful life only because of their bad skill of money management behavior, they don’t even know how to save money.

It doesn’t matter how much you earn, if you do not have any basic knowledge of financial planning then you are definitely going to face a very unhealthy financial future. So here are 8 personal finance tips on how to save money.

They say if you don`t know how to manage money then money will start managing you and you will be left with nothing but empty-handed.

8 Simple Tips on How to Save Money From Salary

To achieve your financial goals which provide you with greater financial security then you have to learn about how to start managing your money from the very beginning of your financial life.

Plan Your Monthly Budget

The best way to start your money management journey is by creating a monthly budget. Making a monthly budget is easy but sticking to it is quite difficult. Making a monthly salary budget is an essential step in managing your personal finances.

A well-planned budget is very important to manage your money and helps you to track your income and expenses, and it can also help you to save money, pay off debt, and achieve your financial goals.

Be Prepared for a Financial Emergency (Saving For Emergency)

Start your financial planning by paying yourself. Paying yourself for unexpected expenses. Unexpected expenses like Losing your job, Medical emergency, Sudden home expenses, Family emergencies, etc.

So it’s important to have the plan to face any of these kinds of financial emergencies. Now there are two types of things that can be considered in an emergency situation.

Emergency Fund-

No matter how much you earn, save at least 20% of your income for sudden expenses. You can start an emergency fund, where you could have a fund, savings, or investments which help you to cover your unexpected expenses without any debt or credit.

Insurance-

Insurance also provides you financial protection in emergencies like accidents, illnesses, property damage and etc.

Summarize your income

Summarize your income through your expenses and invest 10 even if your income is 100. Try different methods to know how to save money.

Try to minimize your unnecessary expenses to invest as much as you can and maximize your source of income.

Buy Generics

Buying generics is really helpful in saving money. Instead of buying the original brand buy generic. It saves you money plus makes you fashionable as well. There is nothing wrong with buying generics.

Start Investing Money (Not Saving)

As we all are aware of the fact that the amount of money increases through interest when you put the money in the bank.

It is good but not very beneficial because the interest applied to money and the increase of the amount of money is a slow process.

Also always saving and never investing decreases the amount of money over time because of inflation. Inflation occurs when the price of goods and services increases and the value of money decrease.

It always happens over time. If you look at the era of our childhood/parents the price of general goods and services was low and the value of money was high.

But nowadays, you see that the price of the same goods and services are very high and the value of money is not as it was then.

So apart from just saving salaried money, one can invest it in other fields of different financial options, since technology and the economy are developing nowadays saving money will not be as valuable as after some years.

Investing money from salary in different financial options will act as a supplement for the growth of money. If you are in your 20s to 30s you should minimize your expenses and try to invest as much as possible.

There are many different investment options available in the market like the stock market, Mutual funds, Real estate, etc.

If you already planned your retirement then you must include your goals, you must focus on your fixed requirements first than anything else.

Invest in Assets, Not Liabilities

Liabilities are purchases whose value decreases over time, most of the purchases of our lives are liabilities. Ex- Bad debt, bad investment, interest payable.

Whereas, assets are purchases whose value increases over time. One should own assets more than liabilities.

If we ask our parents about buying assets they will recommend investing in real estate it is the best of investments but sometimes it turns tricky too.

Since with the advancing economy, we have assets other than real states and these are called on-paper assets. Some examples of on-paper assets are- shares, bonds, govt. bond, fixed bonds, sip, etc.

Educate Yourself On Personal Finance

It’s never too late to start learning about personal finance. Educate yourself to make decisions about your money and improve your overall financial well-being.

So never rely on random advice from unqualified and inexperienced people and start reading some best books on financial planning to improve investment decisions. And then you can manage your money very easily.

Here are some benefits of learning money management.

- Better money management

- Better credit management

- Improved investment decisions

- Greater financial independence

- Protection against scams and fraud

Cut Down on Credit Card Spending (Debt & Loans)

Avoid debt, loans, and using credit cards as much as possible. Debts and loans are the biggest flex that could never let your money be saved. Even if you have already in debt try to cover it as soon as possible and never turn toward it again.

ADDITIONAL MONEY-MAKING TIPS

Create Passive Income Sources

These are the sources of income which is acquired automatically with minimal maintenance and labor to earn. Some examples of passive income sources are bonds, funds, rental properties, private equity, etc.

An individual aim should have passive income sources before mid 30’s to have a well-settled future with financial freedom. To have passive income sources one should work hard in his/her 20s in active income sources.

If we look at the lives of highly rich peoples who is always on a vacation or partying and enjoying their lives are the peoples who are involved in passive income sources.

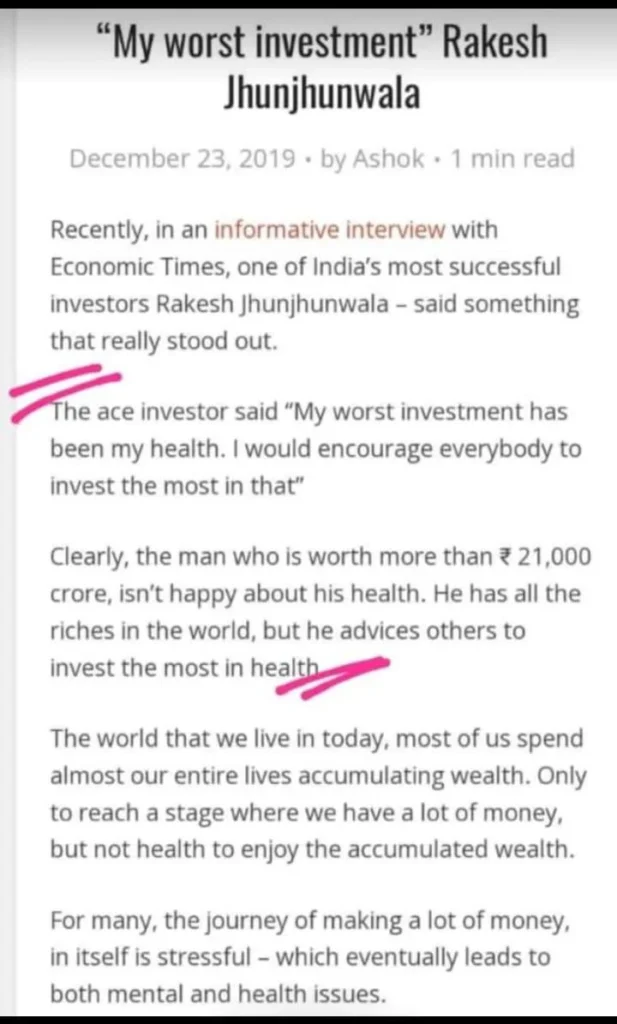

Investing in your health

Once an Indian billionaire Rakesh Jhunjhunwala said that “His worst investment had been his health and urged everyone to invest the most in that”. And definitely, it is the most valuable and profitable investment advice ever.

Start adopting healthy habits and practices because “Health is the biggest wealth”.

Frequently Asked Question

How much money should I save from my salary?

Save at least 20% of your income.

How much money should be in an emergency fund?

At least three to six months’ worth of expenses.

How to make your money work for you?

With a planned Investment.

How to save money with 20,000 salary

No matter how much you earn follow these tips to save your money.