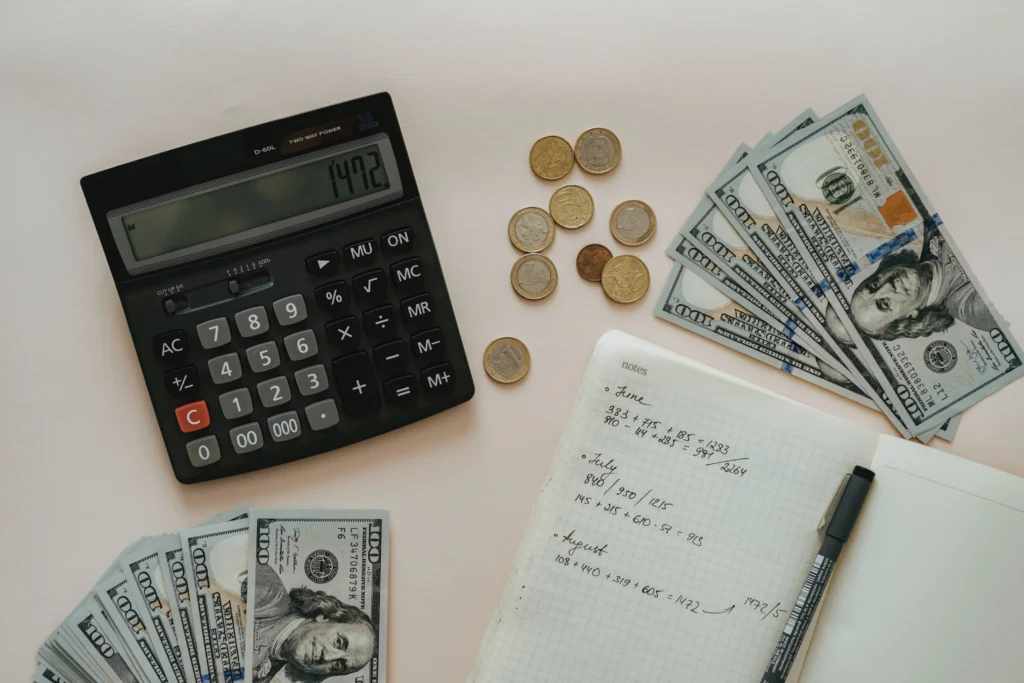

Achieving financial success is a goal that many individuals aspire to attain, and one of the fundamental tools for realizing this objective is effective budgeting. A well-structured budget serves as a roadmap for managing income, expenses, and savings, ultimately leading to financial stability.

In this article, we will explore various budgeting strategies that encompass monthly budgeting, financial planning, expense management, savings strategies, emergency funds, retirement planning, expense reduction, frugal living, cost-cutting, financial goals, debt payoff, savings milestones, variable expenses management, budgeting apps, cash envelope system, budget review, financial adjustment, and income changes.

Budgeting Strategies for Financial Success

Monthly Budgeting

The cornerstone of any successful financial plan is the establishment of a monthly budget.

This involves categorizing income and expenses to gain a comprehensive understanding of your financial inflows and outflows.

Must Read: 8 Simple Tips on How to Save Money From Salary

Start by listing all sources of income, such as salaries, bonuses, or freelance earnings.

Next, catalog all your monthly expenses, including fixed costs like rent or mortgage, utilities, and insurance, and variable expenses like groceries, entertainment, and dining out.

Financial Planning

Financial planning involves setting short-term and long-term goals.

Prioritize your goals, whether it’s saving for a vacation, buying a home, or planning for retirement.

Allocate a portion of your income towards these goals in your budget to ensure consistent progress.

Expense Management

Tracking and managing expenses is crucial for staying within budget limits.

Regularly review your spending patterns, identify areas where you can cut costs, and be mindful of unnecessary expenses.

This will help you redirect funds towards savings or debt reduction.

Savings Strategy

Incorporate a savings strategy into your budget to build a financial safety net. Establish savings milestones, setting aside a specific percentage of your income each month.

Consider automating transfers to a separate savings account to ensure consistency.

Emergency Fund

An emergency fund provides a financial buffer for unexpected expenses, such as medical bills or car repairs.

Aim to build an emergency fund equivalent to three to six months’ worth of living expenses. This fund acts as a safety net during times of financial uncertainty.

Retirement Planning

Include retirement planning in your budget by contributing to retirement accounts regularly. Take advantage of employer-sponsored retirement plans and consider consulting with a financial advisor to ensure your retirement goals align with your budget.

Expense Reduction

Identify areas where you can reduce expenses without sacrificing your quality of life. Evaluate subscription services, renegotiate bills, and seek discounts to trim unnecessary costs. These small adjustments can make a significant impact over time.

Frugal Living and Cost-Cutting

Adopting a frugal lifestyle involves making conscious choices to maximize the value of every dollar spent. Embrace cost-cutting measures by cooking at home, buying generic brands, and opting for affordable alternatives without compromising quality.

Debt Payoff

Prioritize debt repayment in your budget to eliminate high-interest debts. Focus on paying off credit cards and loans systematically, allocating extra funds towards the principal amount to expedite the process.

Variable Expenses Management

Variable expenses can fluctuate, making them challenging to predict. Monitor these expenses closely, and adjust your budget as needed. Allocate a buffer for unforeseen increases in variable costs.

Budgeting Apps

Leverage technology by using budgeting apps to streamline the budgeting process. These apps can automatically categorize transactions, provide insights into spending habits, and offer personalized financial advice.

Cash Envelope System

For those who prefer a tangible approach, the cash envelope system involves allocating specific amounts of cash to different spending categories.

Once the envelope is empty, there are no additional funds available for that category until the next budgeting period.

Budget Review

Regularly review your budget to ensure it aligns with your financial goals. Evaluate your progress, adjust spending categories as needed, and celebrate milestones achieved.

Financial Adjustment

Life circumstances change, and so should your budget. Be flexible and adjust your financial plan as needed. Factor in major life events, such as job changes, marriage, or the birth of a child.

Income Changes

If your income changes, whether due to a promotion, job loss, or additional income streams, adjust your budget accordingly. Allocate extra funds towards savings, debt repayment, or other financial goals.

Implementing effective budgeting strategies is essential for achieving financial success. By combining monthly budgeting, financial planning, and expense management with savings strategies, emergency funds, and retirement planning, individuals can cultivate healthy financial habits.

Adopting expense reduction, frugal living, and cost-cutting measures contributes to a sustainable financial lifestyle.

Regularly reviewing and adjusting the budget, leveraging technology through budgeting apps, and considering tangible systems like the cash envelope method further enhance the effectiveness of these strategies.

With dedication and discipline, individuals can navigate the path to financial success and build a secure financial future.

How budgeting helps ensure financial success?

Budgeting is your key to financial success! It acts like a map, giving you a clear picture of your income and expenses, and guiding you towards your financial goals. Here’s how:

Clarity & Control: You understand where your money goes, avoid impulsive spending, and allocate funds wisely.

Goal Achievement: You align spending with your dreams (house, emergency fund, retirement), track progress, and stay motivated.

Peace of Mind: Reduced stress, preparedness for emergencies, and potentially a better credit score.

What is the 50 20 30 rule for budgeting?

The 50/20/30 rule is a budgeting guideline that suggests allocating 50% of your income to needs, 20% to savings, and 30% to wants.

Essentials like rent and groceries fall under needs, while savings cover financial goals and debt reduction.

The remaining portion, wants, encompasses non-essential expenses like dining out or entertainment.

This rule provides a simple framework for managing finances, promoting a balanced approach to spending, saving, and maintaining financial stability.

Adjustments can be made based on individual circumstances, but the 50/20/30 rule serves as a foundation for effective and organized budgeting.

What are 4 methods of budgeting?

The four main budgeting methods are zero-based budgeting, incremental budgeting, activity-based budgeting, and value-based budgeting.

Zero-based budgeting requires justifying every expense from scratch each period.

Incremental budgeting involves adjusting previous budgets based on changes and additions.

Activity-based budgeting links costs to specific activities and resources.

Value-based budgeting aligns expenditures with strategic goals and value creation.

Each method offers distinct advantages and suits different organizational needs, providing flexibility and control in financial planning processes.